Benton County Arkansas Business Personal Property Tax . the statewide deadline to pay 2023 personal and real estate taxes is tuesday, october 15 th. Click next to pay your personal property and real estate taxes in benton county, arkansas. If residents do not pay their taxes by. on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from january 1. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. search arkansas assessor and collector records online from the comfort of your home. personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. arkansas law requires that all property owners assess their personal property, and their business personal property (if.

from www.formsbank.com

Click next to pay your personal property and real estate taxes in benton county, arkansas. the statewide deadline to pay 2023 personal and real estate taxes is tuesday, october 15 th. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. search arkansas assessor and collector records online from the comfort of your home. personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. arkansas law requires that all property owners assess their personal property, and their business personal property (if. If residents do not pay their taxes by. on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from january 1.

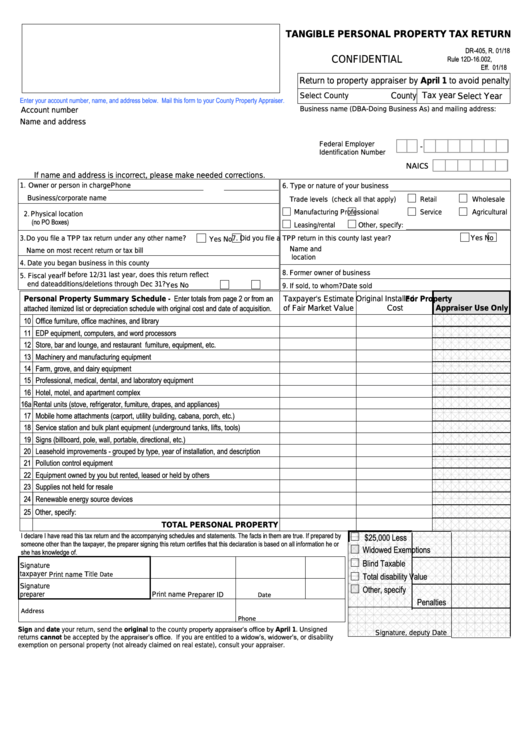

Fillable Form Dr405 Tangible Personal Property Tax Return printable

Benton County Arkansas Business Personal Property Tax on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from january 1. personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. the statewide deadline to pay 2023 personal and real estate taxes is tuesday, october 15 th. arkansas law requires that all property owners assess their personal property, and their business personal property (if. on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from january 1. Click next to pay your personal property and real estate taxes in benton county, arkansas. search arkansas assessor and collector records online from the comfort of your home. If residents do not pay their taxes by.

From www.formsbank.com

Form Pt100 Business Personal Property Return printable pdf download Benton County Arkansas Business Personal Property Tax personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from january 1. this electronic real estate, personal property tax payment service is being offered. Benton County Arkansas Business Personal Property Tax.

From www.pdffiller.com

Tad Business Personal Property Form 1300b Fill Online, Printable Benton County Arkansas Business Personal Property Tax personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. arkansas law requires that all property owners assess their personal property, and their business personal property (if. Click next to pay your personal property and real estate taxes in benton county, arkansas. the statewide deadline to. Benton County Arkansas Business Personal Property Tax.

From www.mapsofworld.com

Benton County Map, Arkansas Benton County Arkansas Business Personal Property Tax search arkansas assessor and collector records online from the comfort of your home. arkansas law requires that all property owners assess their personal property, and their business personal property (if. personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. the statewide deadline to pay. Benton County Arkansas Business Personal Property Tax.

From www.land.com

0.56 acres in Benton County, Arkansas Benton County Arkansas Business Personal Property Tax If residents do not pay their taxes by. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. arkansas law requires that all property owners assess their personal property, and their business personal property (if. the statewide deadline to pay 2023 personal and real estate taxes is tuesday,. Benton County Arkansas Business Personal Property Tax.

From exolvgnae.blob.core.windows.net

How To File Personal Property Taxes at Helen Schaible blog Benton County Arkansas Business Personal Property Tax search arkansas assessor and collector records online from the comfort of your home. If residents do not pay their taxes by. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. Click next to pay your personal property and real estate taxes in benton county, arkansas. the statewide. Benton County Arkansas Business Personal Property Tax.

From www.land.com

5 acres in Benton County, Arkansas Benton County Arkansas Business Personal Property Tax on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from january 1. search arkansas assessor and collector records online from the comfort of your home. If residents do not pay their taxes by. this electronic real estate, personal property tax payment service is being offered. Benton County Arkansas Business Personal Property Tax.

From www.mapsales.com

Benton County, AR Wall Map Premium Style by MarketMAPS MapSales Benton County Arkansas Business Personal Property Tax personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem. Benton County Arkansas Business Personal Property Tax.

From www.dreamstime.com

Arkansas Benton County stock vector. Illustration of roads 78557209 Benton County Arkansas Business Personal Property Tax on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from january 1. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. Click next to pay your personal property and real estate taxes in benton county, arkansas.. Benton County Arkansas Business Personal Property Tax.

From diaocthongthai.com

Map of Benton County, Arkansas Benton County Arkansas Business Personal Property Tax arkansas law requires that all property owners assess their personal property, and their business personal property (if. search arkansas assessor and collector records online from the comfort of your home. the statewide deadline to pay 2023 personal and real estate taxes is tuesday, october 15 th. Click next to pay your personal property and real estate taxes. Benton County Arkansas Business Personal Property Tax.

From www.mappingsolutionsgis.com

Benton County Arkansas 2016 Wall Map, Benton County Parcel Map 2016 Benton County Arkansas Business Personal Property Tax this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. search arkansas assessor and collector records online from the comfort of your home. the statewide deadline to pay 2023 personal and real estate taxes is tuesday, october 15 th. personal property in the possession of a business. Benton County Arkansas Business Personal Property Tax.

From koordinates.com

Benton County, Arkansas Parcels Koordinates Benton County Arkansas Business Personal Property Tax personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. the statewide deadline to pay 2023 personal and real estate taxes is tuesday, october 15 th. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. Click. Benton County Arkansas Business Personal Property Tax.

From www.countyforms.com

Fillable Business Personal Property Tax Return Form Printable Pdf Benton County Arkansas Business Personal Property Tax search arkansas assessor and collector records online from the comfort of your home. If residents do not pay their taxes by. personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for. Benton County Arkansas Business Personal Property Tax.

From exoijivyn.blob.core.windows.net

Benton County Wa Personal Property Tax at Rufus Ricci blog Benton County Arkansas Business Personal Property Tax If residents do not pay their taxes by. Click next to pay your personal property and real estate taxes in benton county, arkansas. arkansas law requires that all property owners assess their personal property, and their business personal property (if. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton. Benton County Arkansas Business Personal Property Tax.

From www.realtor.com

Benton County, AR Real Estate & Homes for Sale Benton County Arkansas Business Personal Property Tax If residents do not pay their taxes by. search arkansas assessor and collector records online from the comfort of your home. Click next to pay your personal property and real estate taxes in benton county, arkansas. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. the statewide. Benton County Arkansas Business Personal Property Tax.

From www.land.com

5 acres in Benton County, Arkansas Benton County Arkansas Business Personal Property Tax personal property in the possession of a business but belonging to someone else should be assessed to its true owner (the. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem. Benton County Arkansas Business Personal Property Tax.

From assessment.bentoncountyor.gov

Business Personal Property EFiling Benton County Assessment, Oregon Benton County Arkansas Business Personal Property Tax search arkansas assessor and collector records online from the comfort of your home. arkansas law requires that all property owners assess their personal property, and their business personal property (if. If residents do not pay their taxes by. the statewide deadline to pay 2023 personal and real estate taxes is tuesday, october 15 th. Click next to. Benton County Arkansas Business Personal Property Tax.

From www.countyforms.com

Fillable Business Personal Property Tax Return Form Printable Pdf Benton County Arkansas Business Personal Property Tax on and after january 1, 1991, taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from january 1. this electronic real estate, personal property tax payment service is being offered to the tax payers of benton county. Click next to pay your personal property and real estate taxes in benton county, arkansas.. Benton County Arkansas Business Personal Property Tax.

From www.dochub.com

Where to get a personal property tax waiver Fill out & sign online Benton County Arkansas Business Personal Property Tax Click next to pay your personal property and real estate taxes in benton county, arkansas. arkansas law requires that all property owners assess their personal property, and their business personal property (if. the statewide deadline to pay 2023 personal and real estate taxes is tuesday, october 15 th. personal property in the possession of a business but. Benton County Arkansas Business Personal Property Tax.